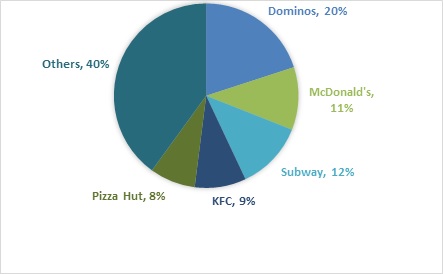

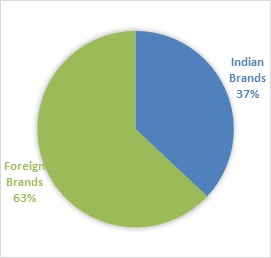

The Indian fast food industry is largely dominated by unorganized retail (which is approximately 95%), which includes stand-alone restaurants, carts and dhabas. The $12.5 billion (approx. ₹776 billion) industry is grew at 36% in FY13. Out of the organized sector, QSR contribute to ₹34 billion. QSR (quick service restaurant) is a fast food restaurant with minimal table service and a fixed menu, e.g. McDonald’s. The QSR market is dominated by foreign players.

Pizza dominates the fast food industry, accounting for 47 to 50 % of overall fast food revenue, compared to 36 % from sandwiches and the remaining 14 % is split by other assorted fast foods. In value terms, pizzas, burgers and sandwiches account for 83 % of the QSR market. The chicken fast-food market is forecast to reach ₹ 13 billion rupees ($207 million) in 2013, while pizza consumers are projected to be worth ₹ 23 billion in 2013. The pizza market in India was ₹15 billion in FY12 and grew at a CAGR of 26% in the last 5 year. The Domino’s has over 55% market share in organized pizza market and 70% market share in pizza home delivery segment. Newer types of fast food are also taking off in India, too, including Latin American fast food (Taco Bell).

Growth

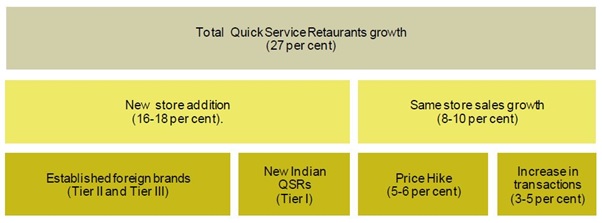

The Indian QSR industry is expected to grow at a CAGR of 27 % for the period from 2012-16.

Key growth drivers

Higher disposable incomes, changing consumption patterns and the marketing might of powerful international brands are the key factors supporting the development of fast food industry in India. With 65% of India’s population below 35, many Indians fall in the 15-35 age bracket (including students and young working adults), the target audience of fast food industry. As many as 530 million Indians will reside in urban areas by 2020. There is growth in disposable incomes with income elasticity of 1.4x. There is also a rise in nuclear families and youth spending. The rising urban middle class is also changing its food habits. As per FY12 data, Indians are eating outside more often, as many as 7 times a month. The paucity of time and the wider penetration of a Western-style culture will further fuel the growth of fast food in India. Companies are expected to target not just urban areas but also tier II and tier III cities in a bid to strengthen their presence. International brands such as McDonald’s, KFC and Subway have considerable resources in terms of spending on marketing and promotional activity, a factor that will further drive the category’s development.

New outlets to largely aid growth in QSR market

Growth in the Indian QSR industry is expected to be largely driven by new outlets. We expect outlet additions to continue to grow at an average annual rate of 16-18 %. The remaining 8-10 % growth is expected to come through an increase in same store sales. Of the total store additions, we believe that 40-45 % will take place in tier II and tier III cities. Currently these markets account for just 25 % of total outlets. For large, established players who already have a sizeable presence in tier I cities, tier II and tier III markets are expected to account for roughly 70 % of store additions over the next three years. Large players have already established a strong brand and are better-placed to take advantage of the lower lease rentals and limited competition that smaller cities offer. On the other hand, new entrants and relatively new Indian QSR brands are expected to focus more on larger cities and consolidate operations in a single region before moving on to newer markets.

Same store sales growth to remain subdued in the near term

Same store sales, which have been growing at a robust 20-25 % over the past few years, are expected to slow down significantly in the near term. Two factors will cause the decline in growth:

1) An economic slowdown, which will curb discretionary spending;

2) Cannibalisation due to opening of multiple outlets in the same catchment area and a resultant increase in competition.

Growth in same store sales is expected to come from a 5-6 % hike in prices (in line with the typical hikes made every year) and a 3-5 % increase in the number of transactions at existing stores. Stores set up in the last couple of years are expected to see a higher increase in transactions per outlet, as new stores usually take 2-3 years to ramp up operations.

Recent happenings

In a recent development, Nando, South Africa-based Afro-Portuguese, global restaurant chain has plans of starting up around 35 outlets in various parts of India through the franchise route by 2014. The company expects to expand enormously in the northern parts of India.

Mukesh Ambani-led Reliance Industries Ltd (RIL) plans to open a quick service restaurant (QSR) chain called ‘Chicken Came First’ in India in partnership with a UK-based company, as per a report in The Times of India. The firm through its retail venture Reliance Retail has picked 45 % stake in an Indian joint venture with UK-based food service company 2 Sisters Food Group Ltd (2SFG). The JV, Two Sisters Foods India Ltd, will initially be a supplier of chilled and frozen food at its food and grocery outlets in the country and later set up its own QSR chain under the brand Chicken Came First, the report said citing sources.

Burger King, one of the world’s top fast-food companies, will soon enter India through a franchising partnership with a company that will be headed by the present CEO of its UK operations and majority-owned by private equity firm Everstone Capital. This would be a rare instance where a PE fund would be partnering with a fast-food chain.

Trends

Indianized offerings

In an effort to appeal to the palates of Indian consumers, operators of multinational brands such as McDonald’s, KFC and Subway have changed their food offerings, particularly increasing the vegetarian options. This is mainly because India has a huge population of vegetarians. Multinational fast food brands have long adapted their Indian menus to cater to local tastes, with plenty of spice and vegetarian options. The first vegetarian McDonald’s opened in 2013 in northern India near the famous Golden Temple in Amritsar. Some of the multinational brands like Subway have also taken this trend to the next level, introducing Jain variants in Gujarat targeting the country’s Jain community.

Franchising model

On the strategic front, it has been found that the franchising concept in India is continuously rising with the increase in the number of international players opening more franchise outlets in India. The increasing revenue figures from franchise outlets encourage the players to opt for the concept. As a result, many international fast food giants are opening up their franchise outlets in India to grab the huge untapped potential in a fast emerging market.

Indian fast food chains

To compete effectively with their global peers, Indian players such as Jumbo King, Kaati Zone and Faaso’s have adopted the centralised kitchen model. Investing in centralised cooking and supply chain facilities is critical to success in the QSR space, as it ensures quality and consistency across outlets, and helps players reap the benefits of bulk procurement. Some Indian players also serve global cuisine laced with Indian spices to satisfy the local taste.

Laws governing the food industry

The Indian food industry is regulated mainly by the Food Safety and Standards Act (FSSA), 2006 which govern the aspects of sanitation, licensing and other necessary permits that are required to start up and run a food business. FSSA initiated harmonization of India’s food regulations as per international standards. It established a new national regulatory body, the Food Safety and Standards Authority of India (FSSAI), to develop scientific methods & standards for food and to regulate and monitor the manufacturing, processing, storage, distribution, sales and import of food so as to ensure the availability of safe and wholesome food for human consumption.

Conclusion

Increasing inclination of people to eat outside (restaurants) will be the major driving force behind the projected growth. Besides, healthy food options and low-price menu will also contribute to its growth, to attain a CAGR of around 27 % during 2012-2016. Moreover, continuous economic growth and improving employment situation will lead to higher personal expenditures on outside food. Fast food joints will also need to maintain their stance on pricing because the environment will remain extremely competitive. Hence, it is believed that the fast food industry will experience modest improvement in the coming years.

References

http://www.globalthen.com/qsr/pdf/Indian%20Fast%20Food%20Industry.pdf

http://crisil.com/pdf/research/CRISIL%20Research_Article_QSR_17Sep2013.pdf

http://www.eiu.com/industry/article/311021215/india-food-fast-growth-for-cheap-eats/2013-10-03

http://www.euromonitor.com/fast-food-in-india/report

http://www.fnbnews.com/article/detnews.asp?articleid=34371&SectionId=15

http://www.cnbc.com/id/101321608

https://globalconnections.hsbc.com/us/en/articles/making-meal-indias-fast-food-market

I must say, you have shared few restaurant start-up insights that were not known to me.

I have also written a post about the same topic on my personal blog, i hope you will not mind it accepting it within comments for further reading.

http://www.buzzparas.com/2014/11/restaurant-startup-4722