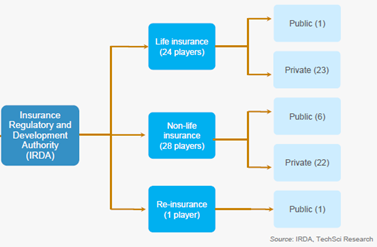

The insurance industry in India consists of 52 companies in all

- Life Insurance (24)

- General (Non-Life) Insurance (28)

On 6th January 2000, the President of India gave his assent to the Insurance Regulatory and Development Authority of India (IRDAI) Bill, which enabled opening up of the insurance sector to private players.

Insurance Laws (Amendment) Act, 2015 has provisioned for increasing the Foreign Investment Cap in an Indian Insurance Company from 26% to 49% with the safeguard of Indian Ownership and Control.

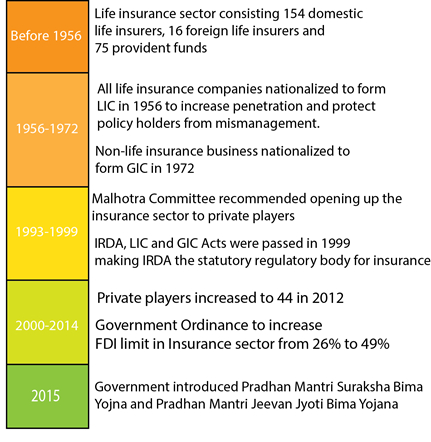

History

Segments of the industry

Distribution Channels and other intermediaries

- Intermediaries involved in distribution of insurance products are agents, brokers, web aggregators, Common Service Centers.

- Intermediaries like surveyors and loss assessors are involved in claim assessment of general insurance.

- Specialized intermediaries for health services called Third Party Administrators (TPAs) operate in Health insurance for issuance of policy cards, for organizing cash less treatment facility through network of hospitals, handling and settlement of claims.

- Insurance Repositories are intermediaries introduced recently to electronically maintain data of insurance policies for ease in storage, retrieval and servicing of insurance policies

Insurance Ombudsman

- Grievance redressal mechanism is provided for in the insurance sector through the institution of Insurance Ombudsman set up under the Redressal of Public Grievance Rules, 1998.

- Complaints that can be taken are partial or complete repudiation of claims and delay in settlement, non-issuance of policy, dispute relating to premium and interpretation of clauses in relation to claim.

- If not satisfied, the policyholder may ignore the award and go to the court, consumer forum etc., and if the customer consents, the insurer has to implement the award unless it chooses to approach Court.

Market Size

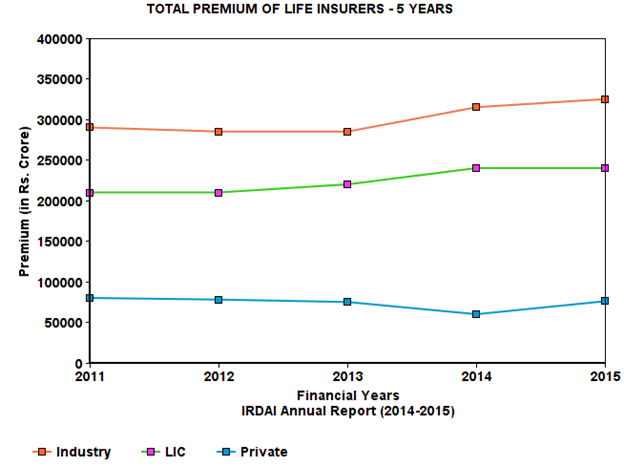

The life insurance sector in India grew from $ 10.5 billion in FY-02 to $ 61.78 billion in FY-15. In this period, the premium collected in life insurance expanded at a CAGR of 14.7%.

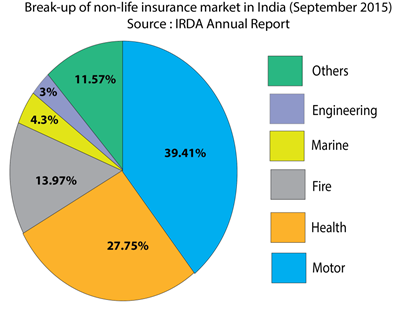

The general insurance market grew from $ 2.6 billion in FY-02 to $ 13.9 billion in FY-15. In this period, the premium collected in non-life insurance expanded at a CAGR of 13.8%. The number of policies issued grew from 43.6 million in FY-03 to 126 million in FY-15, at a CAGR of 9.2%

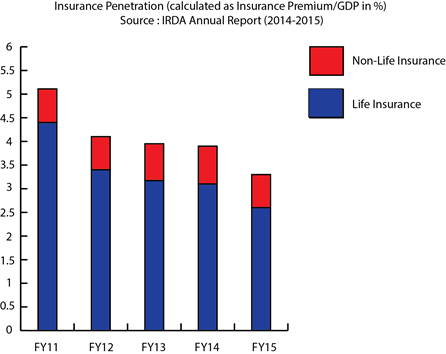

Insurance density in India grew from 3.57 in FY-05 to 11.23 in FY-15 at a CAGR of 12.1%. Insurance penetration was 3.3% in FY15.

India is the biggest life insurance sector in the world with close to 360 million policies. India’s insurance market is expected to grow 4 times in terms of premium collected in the next decade. During this time, life insurance market is deemed to cross $160 billion. India’s Insurance industry intends to reach penetration level of 5% by 2020.

India currently accounts for less than 1.5% of the world’s total insurance premiums and about 2% of the world’s life insurance premiums in spite of being the second most populous country. It is the 15th largest insurance market across the globe with respect to premium volume.

Drivers for the Insurance Industry

Improving Consumer interest in insurance & healthcare

Healthcare facilities have improved with the cutting-edge technology but so have the costs. It seems a sensible choice to be insured to account for any such future expenses. With a huge percentage of working age population with disposable income, it also acts as a tax-saving financial instrument.

“Premium collected by Indian insurers is 3.30% of GDP in FY 2014-15”

– Insurance Regulatory and Development Authority

Insurance & Manufacturing sectors on the way up

The ‘Make in India’ initiative will boost the manufacturing sector for all the industries. Consequently, this will make the stakeholders ensure their cargo and properties. The infrastructure includes the construction of various amenities and facilities like dams, highways and the likes. Despite a gloomy global outlook, India has managed to maintain a good market sentiment in the infrastructure sector.

Travel Industry Upbeat

The tourism industry has benefited a lot with a weakened Dollar and other currencies. More people than ever are considering foreign destination for vacations. This complements the insurance sector since every leg of travel and stay is insured including the flights and other means of transportation. The passenger traffic is surging in the upward path thus improving the prospects of the insurance industry.

Auto Industry Insurance Surge

Insurance covers for all vehicles is not a new factor contributing however it is worth noting that recent flooding events in Chennai caused a spike in the insurance claims. However, it also made automobile owners run for insurance cover to account for natural calamities.

Additionally, the insurance industry caters to an ever increasing market of automobiles in India.

FDI up from 26% to 49%

Effective May 2015, the government liberalized FDI in the insurance sector from the then existing 26% to 49%. This substantial increase in the capital foreign investors can pump into the Indian market will definitely benefit this sector given how capital-intensive it gets.

“According to IRDAI, the total FDI in insurance sector as on March 31, 2015, was about Rs.8,031 crore.”

– ASSOCHAM

Major Players in the Insurance Industry

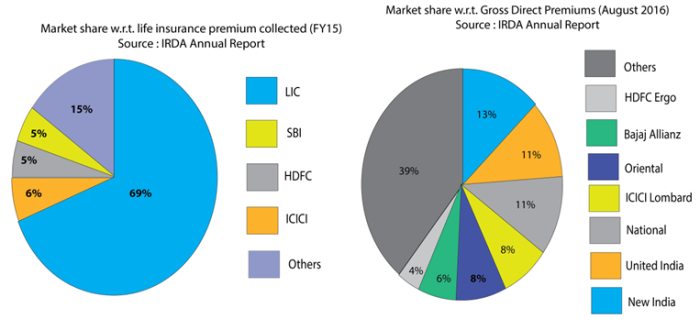

Life Insurance Corporation of India has a lion’s share in the pie. A 69% market despite numerous players has been strongly based on its brand and credibility as a representative of the government.

The non-life insurers’ market is an altogether different story with private players dominating up to a very large extent.

The comprehensive list of life and non-life insurers can be accessed at below link:

| 2014

(Crore) |

2015

(Crore) |

2016

(Crore) |

|

| LIC | 1656 | 1823 | 2518 |

| ICICI Prudential | 1566 | 1634 | 1650 |

| Bajaj Allianz | 1024 | 876 | 878 |

| SBI Life Insurance | 740 | 820 | 861 |

| HDFC Life Insurance | 725 | 785 | 818 |

| United India Insurance | 527 | 300 | 200 |

| Birla Sun Life | 370 | 285 | 140 |

| Reliance Nippon Life Insurance | 358 | 135 | 197 |

| Max Life Insurance | 435 | 414 | 439 |

List of Life & Non-Life Insurers

PAT for major players (Source: respective annual reports)

*As per section 28 of LIC Act, 1956, 95% of the profits are returned to policy holders through bonuses effectively meaning the profits on the P&L statement are 5% of the actual

News & Developments

FDI limit hiked up to 49% from existing 26%

Paving way for FIIs to invest in India, the government has taken another step towards progress. With a substantial capital inflow, the insurance sector can definitely attract more takers with innovative schemes and improved services ensuring the incumbent leaders do not slack up.

Pradhan Mantri Suraksha Bima Yojana

As an initiative to improve insurance penetration, Government of India introduced the above scheme wherein for a nominal premium of Rs.12 per annum, an individual is insured for maximum sum of Rs.2 lakh.

Health Insurance Probability

Though not a latest update, this policy update has remarkable implications with the consumer benefited in terms of service provided by insurers. All insurers must allow credit gained by the customer for existing conditions (sum assured, premiums, waiting period, etc.) if consumer decides to switch the insurance company or the plan.

IRDA (Issuance of Capital by General Insurance Companies) regulation, 2012

This amendment provides for an insurance company operating for more than 10 years to raise capital through IPOs subject to fulfilling other prerequisites.

Porter’s Five Forces Analysis

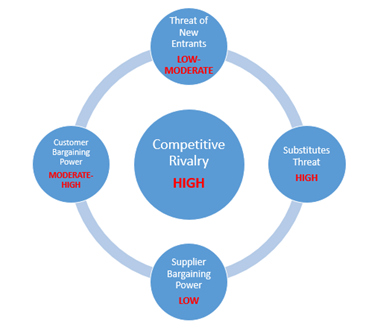

Existing Competitive Rivalry

With 52 players in the arena, the competition has heated up with the consumer having multiple choices to choose from. Though LIC of India has the majority of the market share and despite any unlikely changes in the incumbent’s outreach, the private players are coming up with innovative schemes to attract the customers.

Threat of Substitutes

Though there exist a limited number of competitors, the threat of substitution is substantial since the insurance products are evenly matched in almost all aspects. It becomes easy for the consumer to switch insurers if he does not continue to see value for his investments. This threat is compounded by the fact that the regulator facilitates such a move called “porting”

Bargaining Power of Customers

The customer is indeed the king here since he has tremendous bargaining power in terms of the customizations he needs and the options he has. Insurers today have agents servicing individual customer requirements. This has made insurance easily accessible to anyone.

Bargaining Power of Supliers

Suppliers here are the insurance distributors/agents. They tend to have a lower bargaining power than the customers partly because volume of policies is an important target. Competitors only make it more difficult for them to hold any kind of advantage with the insurance companies since policies can be substituted easily. With the advent of E-Commerce, insurance can be obtained without any interaction with agents. This is another roadblock the suppliers face reducing their weightage since insurance companies utilize these alternative modes of communications which are easier and cheaper.

Threat of New Competitors

Licensing and regulations are strictly enforced by IRDA making it a not-so-easily-accessible market for private players to enter. An organization with enough financial backing and a brand name can establish itself but despite liberalization since 1991, very little has changed in this industry with LIC of India being the most trusted and go-to brand.

Investments in Insurance Sector

- Aegon has increased its investment in Aegon Religare Life Insurance Company Ltd. from 26% to 49%

- Japan’s Nippon Life Insurance increased its stake in Reliance Life from 26% to 49% in a deal worth Rs.2265 crore with total stake valued at Rs.8630 crore.

- Bupa group raised its stake in Max India Life Insurance from 26% to 49% in a deal worth Rs.207 crore.

- France’s AXA invested Rs.1290 cr in Bharti AXA Insurance increasing its stake by 23% to 49%

Conclusion

The insurance industry as we have today is dominated by LIC of India. It would definitely be a Herculean task to displace it off the pedestal as its firmly placed due to the legacy it carries and the people outreach it has. Private players will find it difficult to sustain in such choppy waters. The only approach as of now they can adopt is to fend off the competition before even considering to take on the industry leader.

From consumer perspective, the options have increased and improved with customizations available to suit individual requirements. This coupled with an augmenting penetration of insurance for has ensured this sector progresses with time. It’s a bright outlook to this industry despite the trying times for the world economy with a sluggish growth.

References

IRDAI Annual Report 2014-2015, Insurance Sector in India – IBEF, Indian Insurance Market, Insurance Trends – policybazaar.com, Insurance Industry – Challenges, reforms and realignment (E&Y), CRISIL – ASSOCHAM Insurance Report